#1

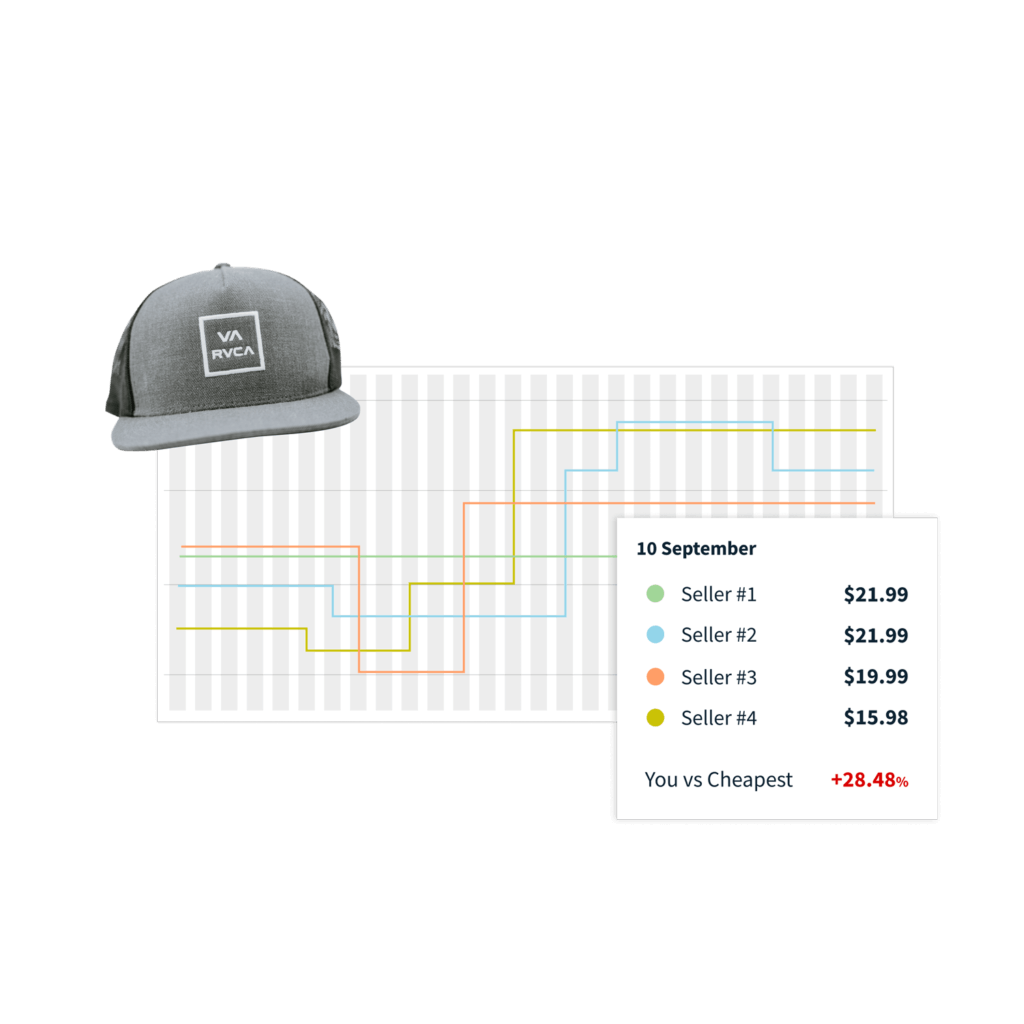

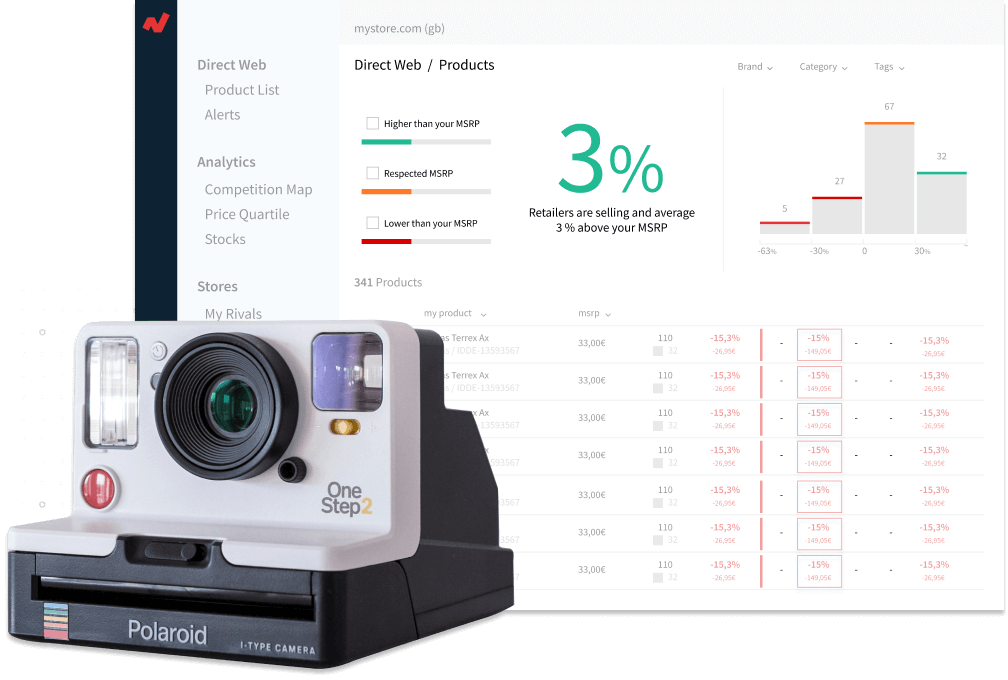

Find out who's the first to lower the price

All price wars start with a small price change. Smaller retailers follow then the price changes made by stronger competitors.

#2

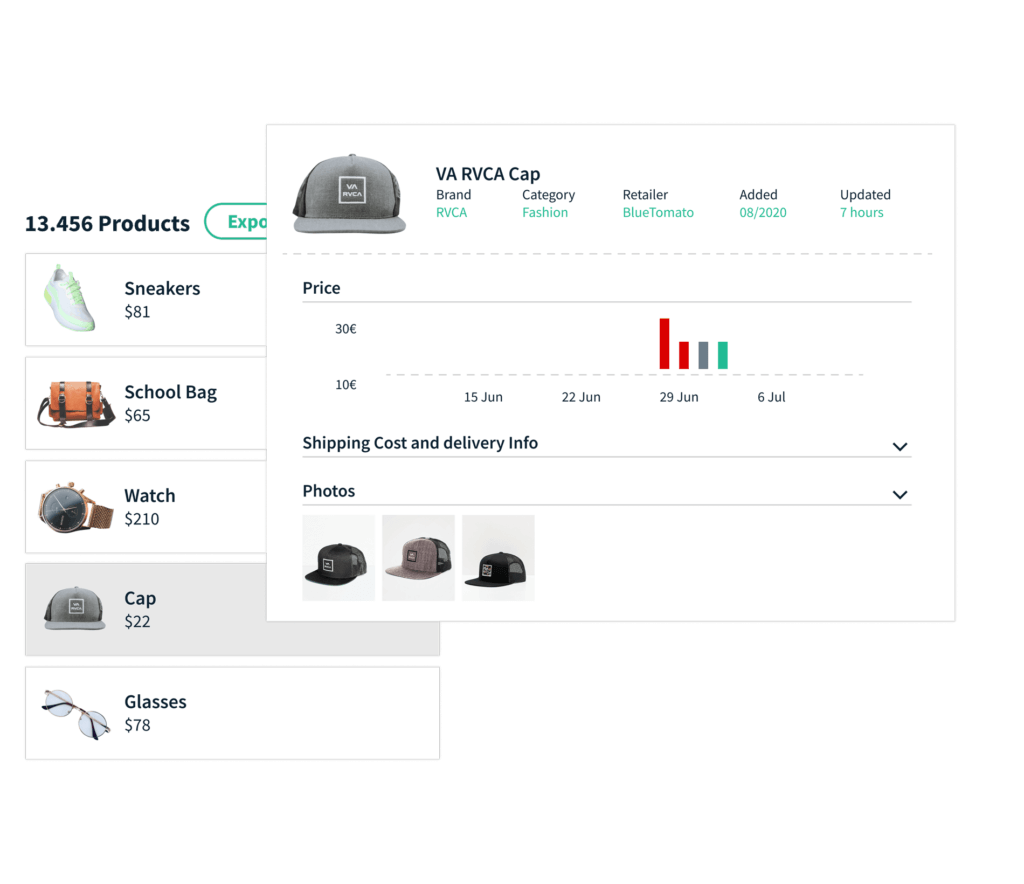

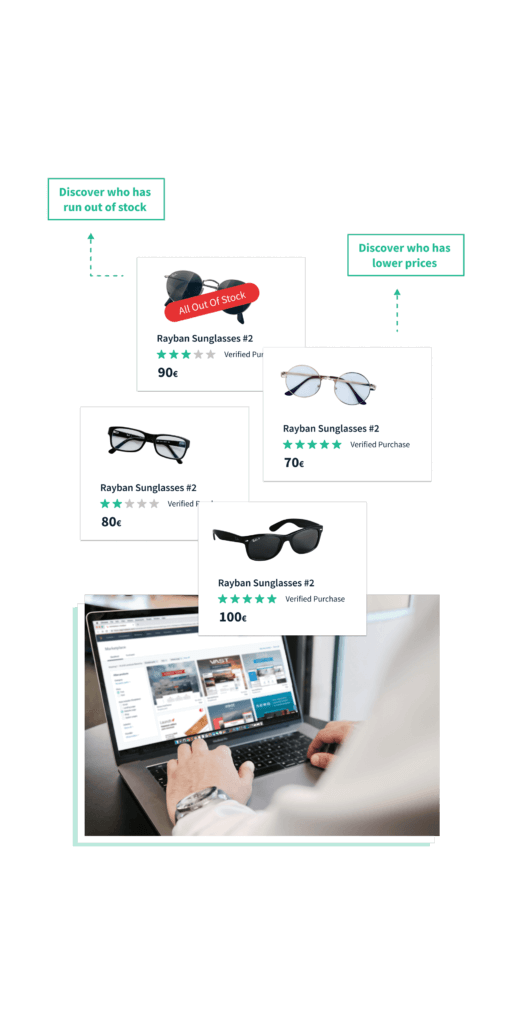

Find out which stores have run out of stock

Since you have the option of monitoring the information via direct website from each of the sellers of your products, you can visualize their stock availability for each product and make commercial proposals when your customers need it the most.

#3

Analyze the composition of each seller's catalogue

Let’s imagine the next case: Retailer A is a vertical in sector X. 90% of its catalogue is made up of families of products very similar to yours. On the other hand, Retailer B is a store that sells products from sector X, Y and Z. Your products and those of your direct competing brands represent only 6% of that specific seller’s catalogue.

In the case of Retailer A, you will have to fight much harder to get a good sale price since this retailer has many of your direct competitors in his catalogue. In the case of Seller B, neither your brand nor those of your competitors represent a very significant amount of their catalogue. For this reason, you are unlikely to have as many options for comparing the prices of your products with those competing brands.

#4

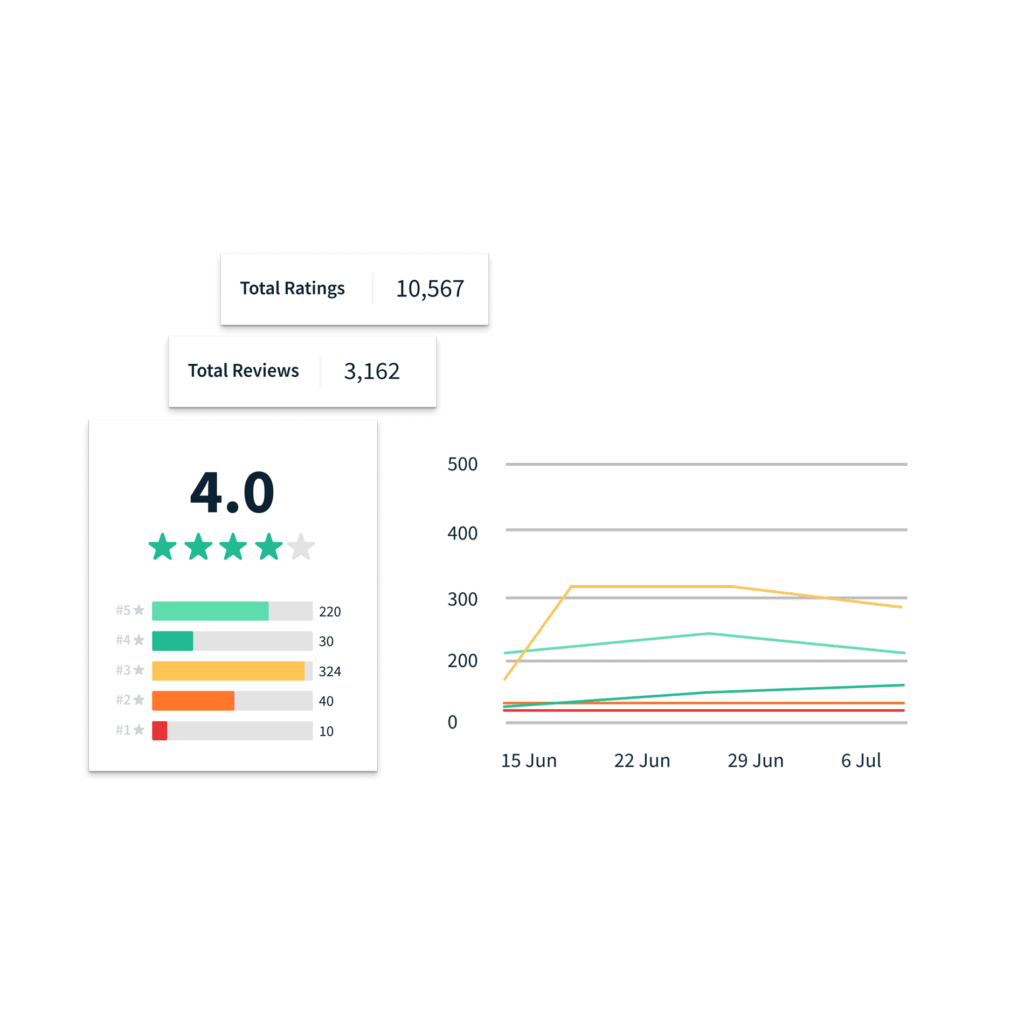

Determine the relevance of your brand

in your retailers’ catalogs

Through the BI (Business Intelligence) module and the functionality of Catalog Explorer you will be able to know more about your brand’s position in the catalogs of retailers. You will be able to visualize what percentage your brand represents in their catalogs, and you will be able to explore this type of information regarding other brands.