Price escalation is the increase in expenditure that occurs when a product is exported to a foreign market, because there are now export-related expenses such as tariffs, increased distribution costs, etc.

If you want to expand your commerce to international markets you must take into account the cost escalation as well as adapt to the regulations of the new countries in which you want to operate. If you want to expand within the EMU, you will have no obstacles. On the other hand, when acting in countries where there is no harmonization of laws you will have to take care of the cost escalation.

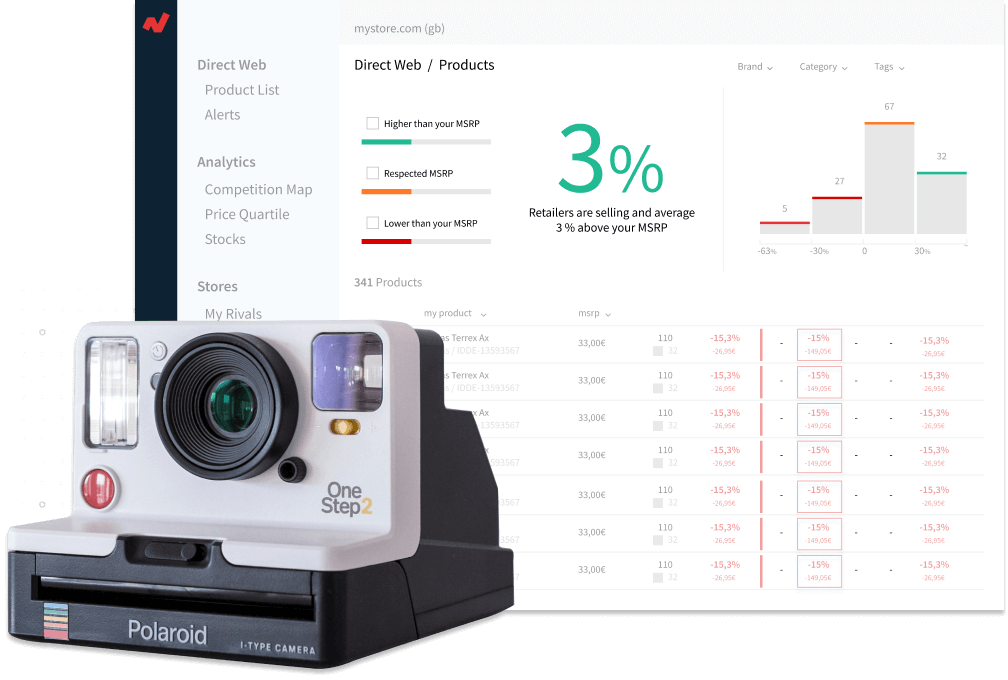

To avoid a price increase of your products, which would result in fewer profit, it is necessary to understand where you want to operate. You can monitor your competitors’ foreign channels to observe their behavior and know what your position would be in the international market. Following your competitors manually can be a difficult task, so to track them efficiently, you have price monitoring tools at your disposal to compare your products with those of the competition automatically and periodically.

The information received through the price monitoring software will allow you to develop a strategy based on price intelligence, in other words, to assess the final impact on consumers’ purchase decisions that cost escalation may have. This methodology will improve the performance of your business in foreign markets and increase the amount of goods sold.

This knowledge can also be applied to other aspects of your business, such as price renegotiation with suppliers or improving the efficiency of the distribution/storage channel of your products.

How to overcome cost escalation?

To sell your goods abroad without fear of reducing your profits you can manufacture the product in the country you want to sell it, instead of exporting it from the country of origin. This practice can be a relief if your business has enough volume to be able to carry out these operations, in case you cannot do it, buying from local suppliers can be a suitable solution to your problem.

Reclassifying the products you export into other classifications with lower tariffs or duties is a valid but complicated idea. A clear example would be the intention of the manufacturers of the alcoholic beverage Cachaça, which in Europe and the USA is still considered a variety of rum, to have a different classification and tariff from rum.

Producing and/or selling your products in a free trade zone is a viable option for your business. You can consult your legal department if the countries in which you want to export are within an FTZ so that you can save on some of the costs associated with exporting.

To avoid reducing profits you will have to take into account the inflation rate in the international markets you are going to operate as well as the foreign exchange rate. A product that in your original market may be perceived as mid-range, depending on which markets, can be considered a premium or high-end product.